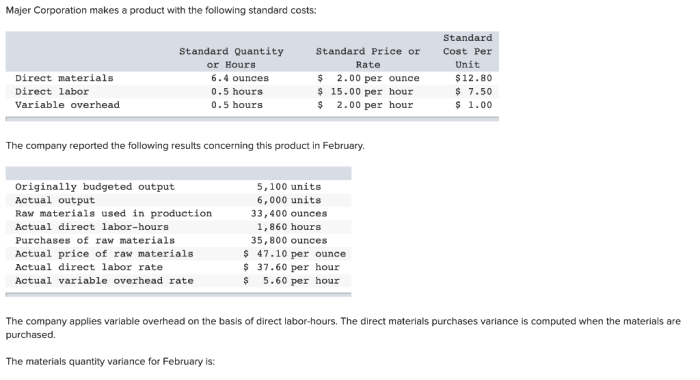

Majer corporation makes a product with the following standard costs – Majer Corporation’s meticulous approach to product costing, underpinned by a robust standard costing system, sets the stage for a deep dive into the intricacies of direct material, direct labor, and manufacturing overhead costs. This analysis unveils the nuances of cost management and variance analysis, empowering businesses to identify areas for improvement and maximize profitability.

Direct Material Costs

Direct material costs are the costs of the materials that are directly used in the production of a product. These costs can include the cost of raw materials, such as wood, metal, or plastic, as well as the cost of components, such as screws, bolts, or wires.

Direct material costs have a significant impact on the overall cost of a product, and they can vary depending on the type of product being produced, the quality of the materials used, and the efficiency of the production process.

For example, in the case of a furniture manufacturer, the direct material costs would include the cost of the wood used to make the furniture, as well as the cost of the fabric or leather used to upholster the furniture.

These costs would have a significant impact on the overall cost of the furniture, and they would need to be carefully managed in order to ensure that the furniture is produced at a profit.

Types of Direct Material Costs

- Raw materials: These are the basic materials that are used to make a product. For example, in the case of a furniture manufacturer, the raw materials would include the wood used to make the furniture.

- Components: These are the parts that are used to assemble a product. For example, in the case of a furniture manufacturer, the components would include the screws, bolts, and wires used to assemble the furniture.

- Subassemblies: These are the parts that are assembled into a larger product. For example, in the case of a furniture manufacturer, the subassemblies would include the drawers and doors that are used to make the furniture.

Direct Labor Costs

Direct labor costs are the costs of the labor that is directly involved in the production of a product. These costs can include the wages of the workers who assemble the product, as well as the wages of the workers who operate the machinery used to produce the product.

Direct labor costs have a significant impact on the overall cost of a product, and they can vary depending on the type of product being produced, the complexity of the production process, and the efficiency of the workers.

For example, in the case of a furniture manufacturer, the direct labor costs would include the wages of the workers who assemble the furniture, as well as the wages of the workers who operate the machinery used to cut and shape the wood.

These costs would have a significant impact on the overall cost of the furniture, and they would need to be carefully managed in order to ensure that the furniture is produced at a profit.

Factors that Influence Direct Labor Costs

- Wage rates: The wage rates of the workers who assemble the product will have a significant impact on the overall cost of the product. For example, if the wage rates of the workers increase, the direct labor costs will also increase.

- Labor efficiency: The efficiency of the workers who assemble the product will also have a significant impact on the overall cost of the product. For example, if the workers are able to assemble the product more quickly, the direct labor costs will be lower.

Manufacturing Overhead Costs

Manufacturing overhead costs are the costs of the activities that are necessary to support the production of a product. These costs can include the cost of rent, utilities, depreciation, and insurance. Manufacturing overhead costs have a significant impact on the overall cost of a product, and they can vary depending on the type of product being produced, the size of the production facility, and the efficiency of the production process.

For example, in the case of a furniture manufacturer, the manufacturing overhead costs would include the cost of rent for the factory, the cost of utilities, the cost of depreciation on the machinery, and the cost of insurance. These costs would have a significant impact on the overall cost of the furniture, and they would need to be carefully managed in order to ensure that the furniture is produced at a profit.

Breakdown of Manufacturing Overhead Costs, Majer corporation makes a product with the following standard costs

- Indirect materials: These are the materials that are used to support the production of a product, but they are not directly used in the production of the product. For example, in the case of a furniture manufacturer, the indirect materials would include the glue used to assemble the furniture, the nails used to secure the furniture, and the sandpaper used to finish the furniture.

- Indirect labor: This is the labor that is used to support the production of a product, but it is not directly involved in the production of the product. For example, in the case of a furniture manufacturer, the indirect labor would include the wages of the workers who maintain the machinery, the wages of the workers who clean the factory, and the wages of the workers who ship the furniture.

- Utilities: These are the costs of the utilities that are used to support the production of a product. For example, in the case of a furniture manufacturer, the utilities would include the cost of electricity, the cost of gas, and the cost of water.

Standard Costing System

A standard costing system is a system that uses standard costs to assign costs to products. Standard costs are based on the expected costs of the materials, labor, and overhead that will be used to produce a product. Standard costing systems are used to control costs and to improve the efficiency of the production process.

To implement a standard costing system, the following steps must be taken:

- Determine the standard costs of the materials, labor, and overhead that will be used to produce the product.

- Assign the standard costs to the products that are produced.

- Compare the actual costs of the materials, labor, and overhead that are used to produce the product to the standard costs.

- Investigate any variances between the actual costs and the standard costs.

- Take corrective action to reduce any variances between the actual costs and the standard costs.

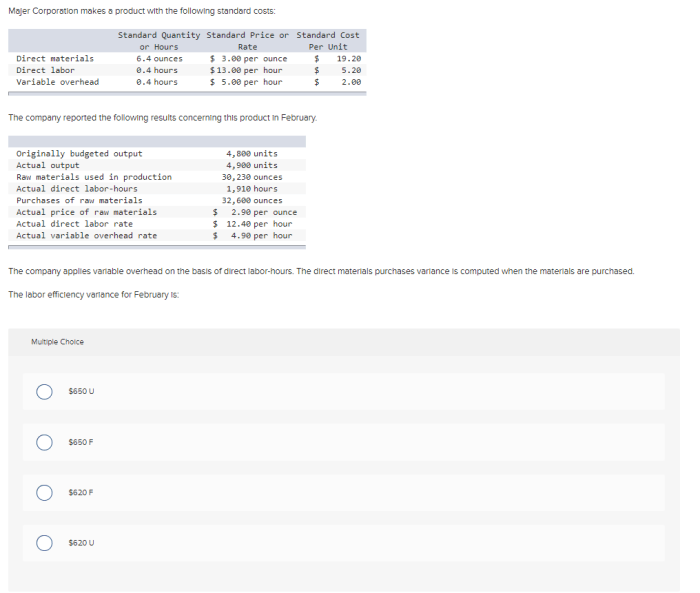

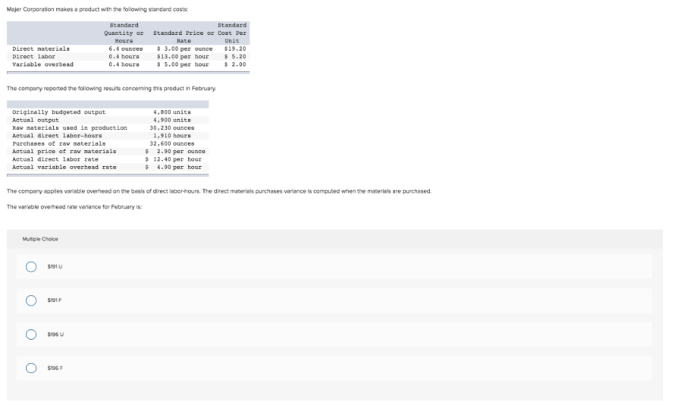

Variance Analysis

Variance analysis is a technique that is used to identify the causes of variances between the actual costs and the standard costs of a product. Variance analysis can be used to identify areas where costs can be reduced and to improve the efficiency of the production process.

There are two types of variances: favorable variances and unfavorable variances. A favorable variance occurs when the actual cost of a product is less than the standard cost. An unfavorable variance occurs when the actual cost of a product is greater than the standard cost.

Variance analysis can be used to identify the causes of both favorable and unfavorable variances. Once the causes of the variances have been identified, corrective action can be taken to reduce the variances and to improve the efficiency of the production process.

Cost Reduction Strategies

There are a number of cost reduction strategies that can be implemented to improve the profitability of a product. These strategies can include:

- Reducing the cost of materials

- Reducing the cost of labor

- Reducing the cost of overhead

- Improving the efficiency of the production process

The implementation of cost reduction strategies can lead to significant savings and can improve the profitability of a product. However, it is important to note that cost reduction strategies should be implemented carefully, as they can also lead to a reduction in the quality of the product or the level of customer service.

Top FAQs: Majer Corporation Makes A Product With The Following Standard Costs

What are the key benefits of implementing a standard costing system?

Standard costing provides a benchmark for evaluating actual costs, facilitates cost control, and supports informed decision-making.

How does variance analysis contribute to cost management?

Variance analysis helps identify deviations from standard costs, allowing managers to pinpoint areas for improvement and take corrective actions.

What are some common cost reduction strategies employed by businesses?

Cost reduction strategies may include optimizing production processes, negotiating favorable supplier contracts, and implementing lean manufacturing techniques.