The price of a trampoline before tax is 300, a figure that invites exploration into the intricate factors that shape its value. This comprehensive analysis delves into the pre-tax composition of a trampoline’s cost, unraveling the interplay of materials, manufacturing, shipping, and market dynamics.

By scrutinizing tax implications, budgeting considerations, and negotiation strategies, we illuminate the path to informed purchasing decisions.

Understanding the breakdown of a trampoline’s pre-tax price empowers consumers to make well-informed choices. It enables them to assess the impact of tax rates on their overall budget and identify potential savings through negotiation. This knowledge empowers consumers to approach trampoline purchases with confidence, ensuring they secure the best value for their investment.

Price Breakdown

The pre-tax price of a trampoline encompasses several components that contribute to its overall cost. These include the materials used in its construction, the manufacturing process, and the shipping expenses involved in delivering the product to the customer.

The materials used in a trampoline play a significant role in determining its price. The frame, which provides the structural support, is typically made of steel or aluminum, with higher-quality materials commanding a premium price. The jumping mat, which is responsible for providing the bounce, is usually constructed from durable materials such as polypropylene or nylon.

The manufacturing process also influences the price of a trampoline. Trampolines that are manufactured using advanced techniques and high-quality control standards tend to be more expensive than those produced with less sophisticated methods. The complexity of the design, the number of components, and the level of automation involved in the manufacturing process all contribute to the overall cost.

Shipping costs are another factor that can affect the pre-tax price of a trampoline. The size and weight of the trampoline, as well as the distance it needs to be shipped, all play a role in determining the shipping expenses.

Trampolines that are larger and heavier, or that need to be shipped over long distances, will typically have higher shipping costs.

In addition to these primary components, there are several other factors that may influence the price of a trampoline. These include brand recognition, market demand, and the availability of discounts or promotions.

Tax Implications

The applicable tax rate for the purchase of a trampoline varies depending on the location of the purchase. In some jurisdictions, trampolines are considered recreational equipment and are subject to a sales tax. In other jurisdictions, trampolines may be exempt from sales tax if they are used for educational or therapeutic purposes.

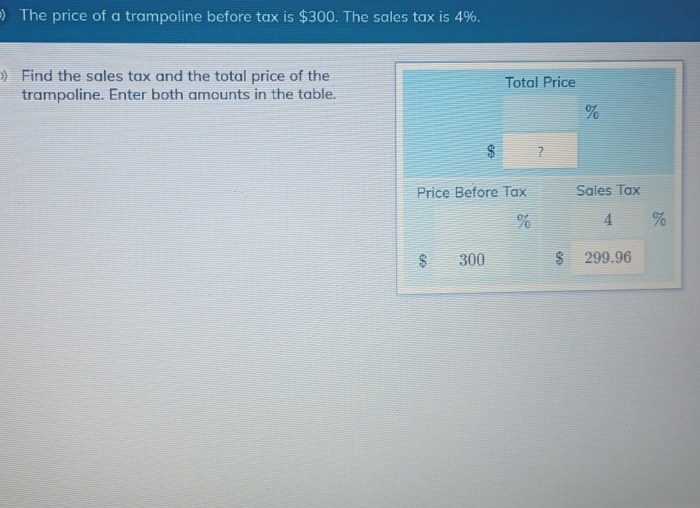

To calculate the amount of tax that will be added to the pre-tax price of a trampoline, the applicable tax rate must be multiplied by the pre-tax price. For example, if the pre-tax price of a trampoline is $300 and the applicable tax rate is 8%, the amount of tax that will be added to the price is $24 (300 x 0.08 = 24).

It is important to note that the tax rate may vary depending on the location of the purchase. For example, the sales tax rate in California is 7.25%, while the sales tax rate in Texas is 6.25%. As a result, the amount of tax that is added to the pre-tax price of a trampoline will vary depending on where it is purchased.

Budgeting Considerations: The Price Of A Trampoline Before Tax Is 300

When budgeting for the purchase of a trampoline, it is important to consider both the pre-tax and post-tax price. The post-tax price is the pre-tax price plus the amount of tax that will be added to the purchase. By considering both the pre-tax and post-tax prices, consumers can avoid any unexpected expenses.

The following table compares the pre-tax and post-tax prices of a trampoline in different jurisdictions:

| Jurisdiction | Pre-Tax Price | Tax Rate | Post-Tax Price |

|---|---|---|---|

| California | $300 | 8% | $324 |

| Texas | $300 | 6.25% | $318.75 |

As the table shows, the post-tax price of a trampoline can vary significantly depending on the location of the purchase. Consumers should be aware of the applicable tax rate in their jurisdiction before budgeting for the purchase of a trampoline.

In addition to the pre-tax and post-tax prices, consumers should also consider any additional costs that may be associated with the purchase of a trampoline. These costs may include assembly, installation, or maintenance. By considering all of the costs associated with the purchase of a trampoline, consumers can avoid any unexpected expenses.

Market Research

Before purchasing a trampoline, it is important to conduct market research to identify the average price range for trampolines. This research can be done by visiting retail stores, searching online retailers, or consulting consumer reports. By understanding the average price range for trampolines, consumers can avoid overpaying for a trampoline.

When conducting market research, it is important to compare the price of the trampoline in question to similar products on the market. This comparison can be done by considering the size, shape, and features of the trampoline. By comparing the price of the trampoline in question to similar products, consumers can determine if the price is fair.

There are several factors that may contribute to price variations between different trampolines. These factors include the brand, the materials used in construction, and the features of the trampoline. By understanding the factors that contribute to price variations, consumers can make an informed decision about which trampoline to purchase.

Negotiation Strategies

In some cases, consumers may be able to negotiate the price of a trampoline with a retailer. There are several different negotiation strategies that can be used to secure a favorable price. One strategy is to ask for a discount.

Another strategy is to offer to pay in cash. By being prepared to negotiate, consumers may be able to save money on the purchase of a trampoline.

When negotiating the price of a trampoline, it is important to be prepared with research. This research should include the average price range for trampolines, as well as the prices of similar products on the market. By being prepared with research, consumers can enter into negotiations with a strong position.

It is also important to be willing to compromise when negotiating the price of a trampoline. This means being willing to accept a price that is less than the original asking price. By being willing to compromise, consumers may be able to reach a mutually acceptable agreement with the retailer.

Additional Costs

In addition to the pre-tax and post-tax prices, there are several additional costs that may be associated with the purchase of a trampoline. These costs may include assembly, installation, or maintenance.

Assembly costs vary depending on the size and complexity of the trampoline. Consumers can save money on assembly costs by assembling the trampoline themselves. However, if the trampoline is large or complex, it may be necessary to hire a professional to assemble the trampoline.

Installation costs vary depending on the location of the trampoline. If the trampoline is being installed in a backyard, the cost of installation will be lower than if the trampoline is being installed on a roof or deck. Consumers can save money on installation costs by installing the trampoline themselves.

However, if the trampoline is being installed in a complex location, it may be necessary to hire a professional to install the trampoline.

Maintenance costs vary depending on the type of trampoline and the frequency of use. Trampolines that are used frequently may require more maintenance than trampolines that are used infrequently. Consumers can save money on maintenance costs by performing basic maintenance tasks themselves.

However, if the trampoline requires major repairs, it may be necessary to hire a professional to repair the trampoline.

By considering all of the costs associated with the purchase of a trampoline, consumers can avoid any unexpected expenses.

Expert Answers

What factors contribute to the pre-tax price of a trampoline?

The pre-tax price of a trampoline encompasses the cost of materials, manufacturing, shipping, and any additional factors such as brand recognition or market demand.

How can I calculate the amount of tax that will be added to the pre-tax price?

To calculate the tax, multiply the pre-tax price by the applicable tax rate for your location.

What are some tips for negotiating the price of a trampoline?

To negotiate effectively, conduct thorough research, be prepared to compromise, and consider the retailer’s perspective.